Those costs can be considerable. The report, "Health Care Expenses and Retirement Income How Escalating Costs Impact Retirement Savings," found that a healthy 65-year-old man can expect to pay $350,000 for health care expenses, including premiums, for the remainder of his life. A 65-year-old woman can expect to pay 13% more at $417,000. Health care expenses increased 5.75% in the 12-month period ending September 2011.

The IRI also shows that the average boomer on Medicare can have out-of-pocket medical expenses of over $4,300 per year. The 2012 Social Security cost-of-living adjustment of 3.6% represents an average $42 per month or $500 per year. In 2012, Medicare Part B premiums will account for over 8% of the average Social Security benefit, the IRI found.

The IRI suggests purchasing an immediate or deferred annuity with a guaranteed minimum withdrawal benefit to supplement Social Security income. Another strategy for boomers who already have an annuity or plan to purchase several years ahead of their retirement is to use income from that annuity to supplement a separate investment.

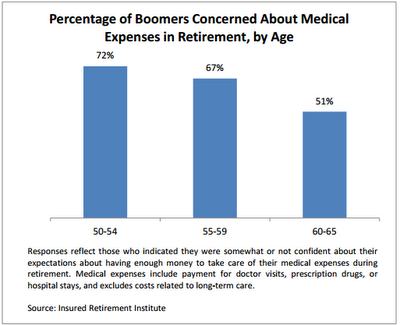

“Boomers are already concerned about their ability to cover their lifelong medical expenses during retirement–therefore, they will likely be open to discussing ways in which to fund the large outlay that will be required,” the report concluded.

Further Reading:

Well the demand for doctors and nurses will only rise and there is not enough of them.

ReplyDeleteSo quality will go down and prices up. You can easily spend a million dollars for a couple. And this just a beginning.

It is hardly possible to save this sort of money on top of your pension for the most of us. The only escape is to try to stay healthy while young and preserve the health.