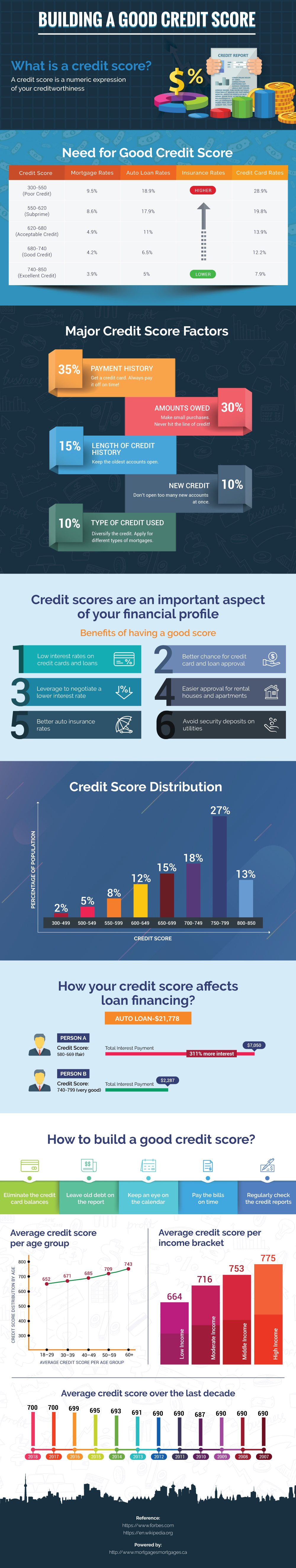

It’s a happy occasion when you’re securing a mortgage! Maybe it’s your first home, or maybe you’re moving to a better location. It’s all smiles until the topic of credit score comes up. Your credit score is a numeric representation of your creditworthiness.

If you pay your bills on time, avoid opening too many credit cards at once and maintain your old accounts, your credit score should be in the “good” to “excellent” range. Events like bankruptcy, or having chronic debt will negatively affect your credit score.

A good credit score puts you in an advantageous position when negotiating loans, approval for a new residence or securing auto insurance. Read on to find out how to get the best possible credit score.

InfoGraphics from http://www.mortgagesmortgages.ca/good-credit-score/

Your credit score can be a thorn in your side, or it can be your secret weapon. Your credit score speaks volumes about your financial history, but it can always be improved! Pay credit card balances in full and try not to carry any debt. A good to excellent credit score is powerful proof that you are financially responsible.

That makes you an ideal candidate when negotiating a loan, mortgage, insurance rate or new residence. Keeping your credit score high is a matter of paying all your bills on time, not initiating too many credit cards at once, and keeping your oldest accounts open.

You’ll be in great financial shape, and have a solid credit score to help you out in your travels! Having a high credit score will make you an ideal candidate when it comes to securing a mortgage, loan or insurance policy.

No comments:

Post a Comment