Buying your ideal house necessitates a significant financial commitment. A house loan can help you buy the home of your dreams. With interest rates at an all-time low, the home loan industry is humming with many appealing offers from multiple banks and financial institutions

Even if an offer entices you, you must exercise extreme caution when choosing a house loan. A minor blunder can have disastrous ramifications for your financial future. Several banks now provide home loans with interest rates as low as 7%.

However, interest rates will not remain steady indefinitely. Bank interest rates are influenced by a variety of things. In this article, we take a look at all the factors that one must keep in mind when applying for a home loan.

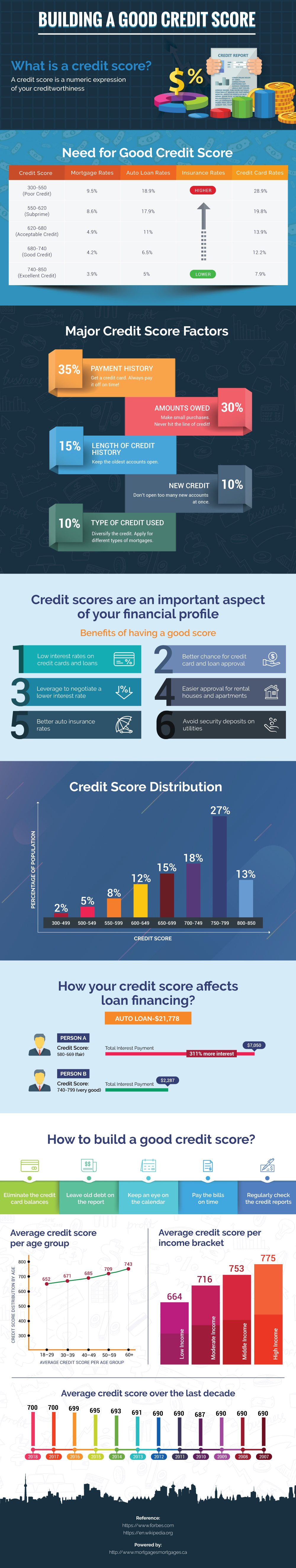

Your credit score is a crucial deciding factor in whether or not you will get approved for a home loan. Your credit score is a numerical assessment that measures your ability to repay your loan.

Credit Rating

Your credit score is a crucial deciding factor in whether or not you will get approved for a home loan. Your credit score is a numerical assessment that measures your ability to repay your loan.

It's a measure of your financial well-being. In basic terms, it demonstrates how diligent you have been in repaying previous bills and credit card payments. Financial companies want to lend to those who have a good credit history.

A good credit score will help you get approved for a loan more quickly. For obtaining a loan, a credit score of 750 or more is considered good, while anything under 700 is considered bad.

You have many loans, and credit card payments due are not an issue. When you apply for a loan, however, consistently missing your EMIs, repaying after the due date, and fluctuating payment of your credit card bills all cause anxiety to the lender.

Existing Debt Obligations

You have many loans, and credit card payments due are not an issue. When you apply for a loan, however, consistently missing your EMIs, repaying after the due date, and fluctuating payment of your credit card bills all cause anxiety to the lender.

Your chances of getting a loan will diminish if the lender notices a pattern. To be eligible for greater sanction amounts at competitive interest rates, it is recommended that you pay your EMIs on schedule and settle any outstanding amounts.

To process your loan application, the lender will charge you a processing fee. Since most banks and housing finance businesses impose processing fees as a fixed percentage of the loan amount, the processing fee is determined by the loan amount.

Processing Fees

To process your loan application, the lender will charge you a processing fee. Since most banks and housing finance businesses impose processing fees as a fixed percentage of the loan amount, the processing fee is determined by the loan amount.

A home loan processing charge typically ranges from 0.5 percent to 1 percent of the loan amount. Some lenders, on the other hand, charge a fixed processing cost regardless of the loan size.

Because house loan amounts are typically large, even a little percentage change can make a big difference. Make sure to go with the lender offering you the best terms and conditions and the lowest processing fee.

Banks pay special attention to applicants who have a higher number of dependents. The more dependents you have, the less likely you are to get approved for a loan with lower home loan interest rates.

Job Security and the Number of Dependents

Banks pay special attention to applicants who have a higher number of dependents. The more dependents you have, the less likely you are to get approved for a loan with lower home loan interest rates.

Lenders assume that as the borrower's monthly paycheck is spent more on dependents, the borrower's loan repayment capacity reduces, resulting in late or missing EMIs. Stable employment and consistent income help to create a positive impression.

When getting a home loan, one of the most significant decisions to make is to carefully choose between the two interest rate plans available in the market: floating and fixed.

In the case of floating interest rates, interest rates fluctuate over time in response to changes in the RBI's base rate and general market conditions.

Type of Interest Rate

When getting a home loan, one of the most significant decisions to make is to carefully choose between the two interest rate plans available in the market: floating and fixed.

In the case of floating interest rates, interest rates fluctuate over time in response to changes in the RBI's base rate and general market conditions.

Floating rates are typically 1% to 2% cheaper than fixed rates, allowing for long-term savings. If a drop in interest rates is projected soon, this choice is appropriate.

In the case of a fixed interest rate, the interest rate does not fluctuate over time. When the economic climate indicates that interest rates will rise, this alternative is appropriate.

A fixed interest rate is preferable for a loan with a short term (less than 7 years). If the loan is for more than 15 years, it is best to accept a floating rate loan because you cannot forecast changes over such a long time. Finally, based on their suitability, an applicant must pick between floating and fixed interest rates.

Home loan insurance, also known as loan cover term assurance, is a form of insurance plan that protects your family financially in the event of your untimely death.

In the case of a fixed interest rate, the interest rate does not fluctuate over time. When the economic climate indicates that interest rates will rise, this alternative is appropriate.

A fixed interest rate is preferable for a loan with a short term (less than 7 years). If the loan is for more than 15 years, it is best to accept a floating rate loan because you cannot forecast changes over such a long time. Finally, based on their suitability, an applicant must pick between floating and fixed interest rates.

Insurance for Home Loans

Home loan insurance, also known as loan cover term assurance, is a form of insurance plan that protects your family financially in the event of your untimely death.

In the unlikely event that something goes wrong, the insurance provider will return the outstanding loan amount for which the insurance cover was obtained. This assures that your family will not be burdened financially by overdue dues.

Many banks and home finance businesses require the purchase of a loan cover term assurance plan to avoid defaults in the event of a disaster.

Keeping a close eye on the shifting RBI rules could benefit you on several levels. You avoid paying any additional fees by foreclosing your home loan by repaying the outstanding amount shorter than the agreed-upon deadline. The sooner you pay off your debt, the better your credit score will be.

Before applying for a house loan, it's critical to double-check your eligibility and other criteria. If you plan to apply for a loan, we recommend keeping the above factors in mind as this will help you close the best home loan deal.

Understand the Laws Regarding Foreclosure

Keeping a close eye on the shifting RBI rules could benefit you on several levels. You avoid paying any additional fees by foreclosing your home loan by repaying the outstanding amount shorter than the agreed-upon deadline. The sooner you pay off your debt, the better your credit score will be.

Before applying for a house loan, it's critical to double-check your eligibility and other criteria. If you plan to apply for a loan, we recommend keeping the above factors in mind as this will help you close the best home loan deal.